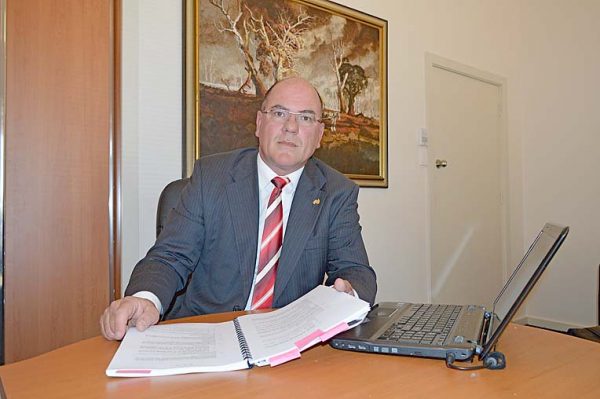

WATTLE Range Mayor Peter Gandolfi yesterday revealed the State Government leased thousands of hectares of land to OneFortyOne Plantations for a 105-year period at a cost of only $1 as part of the forestry forward sale agreement.

Tabling the 2012 lease agreement at council’s monthly meeting on Tuesday evening, Mr Gandolfi said “the 80,000ha land is worth more than $500m, which means the agreement simply does not make financial sense”.

“In addition the rotation period is not set in stone, but flexible after the first rotation,” he said.

“According to the agreement, the 32 to 35-year harvesting interval only applies to the first rotation period.”

After that, OFO could reduce the rotation period according to the terms of the lease.

Mr Gandolfi said the agreement effectively means “the long-term sustainability of the industry is all but secure”.

“Local sawmill operators and others in the supply chain could be in for a rude awakening when the supply of quality log suddenly dries up,” he said.

Mr Gandolfi tabled the lease agreement in question time after a company presentation by OFO chief financial officer Andy Giles-Knopp and OFO Green Triangle general manager Willie van Niekerk.

Reacting on Mr Gandolfi’s rotation concerns, Mr Van Niekerk said OFO’s rotation plan was based on international models that calculate the optimal harvesting age for individual customers.

He said forestry growers around the world used these models, which determine a tree’s “optimal financial benefit age”.

“The optimal harvesting age has been steady between 28 and 32 years for a long period of time,” he said.

Mr Van Niekerk’s words were echoed by Mr Giles-Knopp who said OFO can only manage its sustainability goals on current knowledge.

“The reality is mills operate at a sweet spot of around 32 years, which is a sustainable interval,” he said.

Regarding smaller log availability for local mills, Mr Gandolfi asked whether export was more important to OFO than domestic customers and job sustainability.

He said a local prospective business approached OFO for a small logs supply, but was turned down.

“Clearly export is more important to you than local businesses and jobs,” he said.

“Trees were planted in the region to provide a new industry for the people of the region.

“That is why we opposed the forward sale in the first place.”

Mr Van Niekerk said small log was offered to “a small number of domestic customers regularly”.

“We can continue to support these customers in future, but do not have the reserves to increase our customers base at this stage,” he said.

“It would be irresponsible to expand this client base given the current small log availability.”

However, he said an export outlet was needed because of long-term market irregularity.

“During an upturn in the market an export channel would be needed since the industry cannot – over years – sustain a regular supply of log,” he said.

“In general it is important to remember that OFO represents only 24pc of plantations in the Green Triangle.

“One of our peers represents 50pc of the industry and exports close to 100pc of its product.

“We have increased our domestic supply more than any other forestry grower in the region.

“We paid a fair amount of money for this close to a billion dollar asset and would be silly putting it at risk.

“It won’t benefit us, our shareholders or the community – there’s no value in that.”

Addressing OFO ownership concerns, Mr Giles-Knopp said the Federal Government Future Fund owned 50pc of the company, with the balance owned by overseas-based pension funds.

“The board of directors is representative of the three shareholders on a proportional basis with six members plus a chairperson,” Mr Giles-Knopp said.

He was reluctant to reveal who held control of the board, but conceded it was not the Federal Government Future Fund.

Mr Gandolfi said “it was clear OFO was unwilling to say who actually runs the company” and proposed a letter being sent to

Federal Government Future Fund chairman Peter Costello AC and Finance Minister Mathias Cormann regarding OFO’s intentions in the region.

The motion was carried with Mr Gandolfi to draft a letter “expressing council’s concerns with export and local log provision in the interest of the community given OFO is 50pc Australian-owned”.