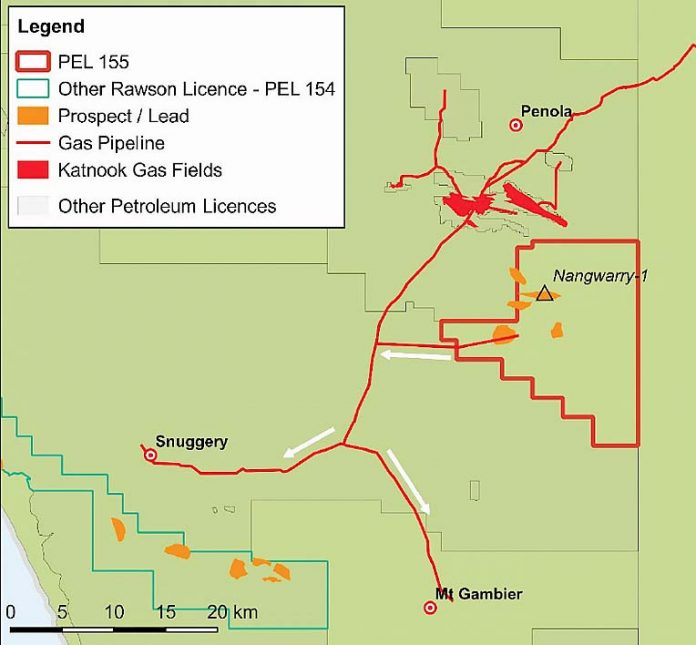

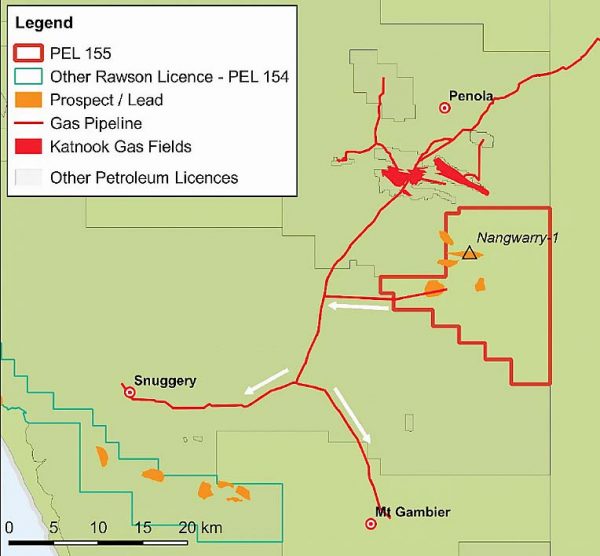

THE newest player in the region’s burgeoning gas exploration industry has announced it has already shored up a sales agreement if gas is discovered at its proposed Nangwarry-1 exploration well north of Mount Gambier.

Rawson Oil and Gas Limited’s announcement comes just days after Beach Energy revealed it would drill two new conventional wells near Penola.

Weston Energy will make a conditional prepayment of up to $6m to Rawson, which will explore for gas 9km south of the recent Beach Energy discovery at Haselgrove-3.

The petroluem company said it wanted to give regional customers more options given high gas prices in Mount Gambier and rebuild the gas industry in the South East.

“We are delighted to have executed this memorandum of understanding with Weston Energy,” Rawson chairman Allister Richardson said.

“With gas prices in the Mount Gambier area as high as $15GJ, I am confident Rawson and Weston can deliver better options for local gas buyers and help build economic prosperity in South Australia.”

Drilling of the Nangwarry-1 well is planned for the 2019 financial year and the company has foreshadowed if gas was found the company would work to have the discovery in production as early as possible.

“In the event of success at Nangwarry-1, we will have a foundation customer to work with as we sell gas into the South Australian market,” Mr Richardson said.

The company also hopes new commercial gas reserves provide stimulus to other industries in the region and alleviate issues of gas supply for power generation and other industries in South Australia.

Weston Energy managing director Garbis Simonian said the company aimed to support Australian domestic businesses and jobs and this memorandum with Rawson was a significant step in delivering competitively priced contract gas to industrial and commercial gas customers in

South Australia.

In a statement to the Australian Stock Exchange by Rawson, it is claimed the memorandum represents a significant step towards signing a binding gas sales agreement between the two parties and covers the purchasing by Weston Energy of up to four petajoules of gas per year for a period of five years.

“The MOU also provides for Weston Energy making a prepayment of up to A$6m, which will give Rawson additional financial flexibility to execute future field development activities,” Rawson said.

“The MOU will allow Rawson to quickly convert any discovered resource into reserves and production.”

An independent petroleum engineering firm has assessed the best estimate prospective resources of the Nangwarry-1 prospect at 57 billion cubic feet of

gas.

The Nangwarry prospect is a conventional gas and liquids prospect in a three-way dip, fault dependent trap and is considered analogous to the nearby Katnook, Haselgrove and Ladbroke Grove fields, which have produced approximately 70 Bcf of raw gas since discovery.

Drilling success at Nangwarry will extend the proven top Pretty Hill play province and/or confirm the presence of a significant new gas reservoir in the Sawpit Sandstone.

PEL 155 is held 50pc by Rawson and 50pc by Vintage Energy.

The PEL 155 JV was awarded $4.95m under the South Australian Government PACE gas scheme in December 2017.

The grant is to support up to 50pc of the drilling of a new gas exploration well within PEL 155.