THE Mount Gambier Community Returned and Service League has overcome its short-term financial woes thanks to a mammoth fundraising effort by the community.

Ready to be placed under voluntary administration less than a week ago, the RSL has made a community-assisted turnaround to fight another day.

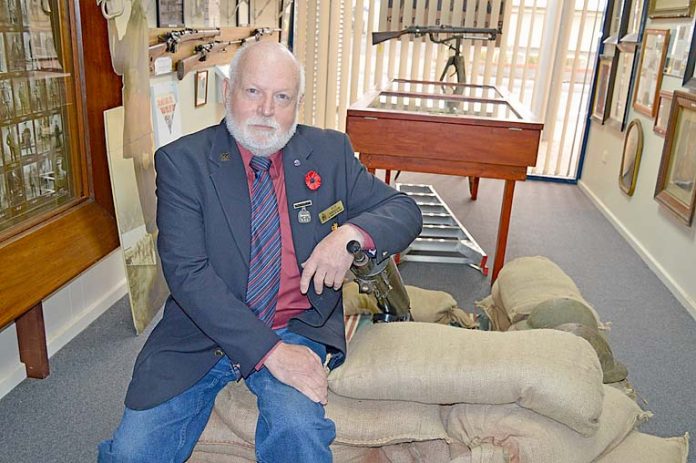

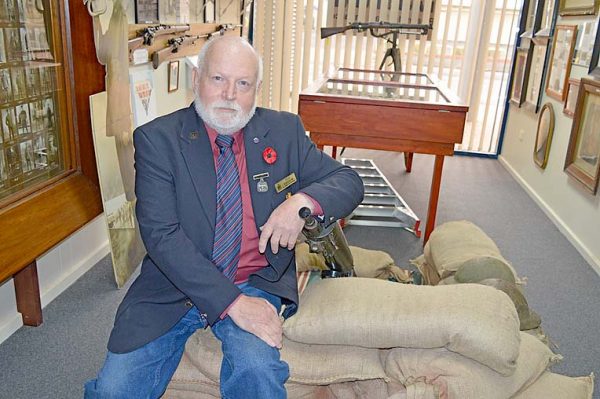

“We are here for another 100 years,” thankful local RSL president Bob Sandow told The Border Watch yesterday.

“Few things can stand in its way when this community comes together.

“It doesn’t matter if it is collecting blankets for the homeless or providing food for those who do not have enough to eat – they really know how to stand together.

“The RSL is deeply grateful to all those who supported us in our hour of need.”

Mr Sandow said the organisation’s financial position still requires attention, but it appears as if the league has secured a positive working capital flow.

“We are also hopeful City Council will vote to lift the current land management agreement on our Ferrers Street car park this Tuesday evening,” he said.

“If that happens we’ll be able to sell the land without any restrictions.

“It would be a big step forward in conjunction with the proposed sale of our adjacent corner block, which is currently home to our artillery display.”

Mr Sandow said although cash donations kept the RSL afloat during past weeks “it was not all about the money”.

“We have one of the best facilities in town here,” he said.

“We want to see it fully utilised and hoped members of the public would come around and give us a go.

“We are here for the community.”

Meanwhile, the RSL has introduced sponsorship forms which have been sent to companies in the Mount Gambier region.

Mr Sandow said companies that have not received forms and are interested should call at the RSL.

Like RSLs across the state and country, Mount Gambier’s league has in recent years battled because of a rapidly declining membership, economic downturn and overall lack of community support.

In addition, the organisation has not been able to cope with repaying a $2m debt incurred in 2009 to build its current premises.

It has been paying interest of around $200,000 a year just on the loan amount, in addition to day-to-day running costs and salaries.