Weaker global beef production set to support prices in second half of 2024

Digital Edition

Subscribe

Get an all ACCESS PASS to the News and your Digital Edition with an online subscription

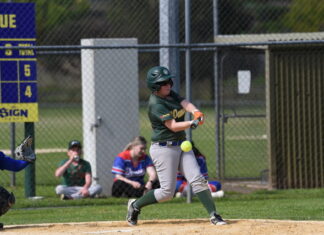

Wanderers win last minor round from Warriors Blue

WANDERERS 8 d WARRIORS BLUE 7

IT was an important game between Wanderers and Warriors Blue, as both teams looked to secure a finals position...