THE region’s largest plantation owner and a gas exploration giant paid no tax in 2015/16, according to a report released by the Australian Tax Office.

The report shows OneFortyOne Plantations’ income for the financial year was more than $295m, but “zero” tax was paid.

Beach Energy – which is drilling for gas south of Penola – posted income of $589m and also did not pay any tax.

The report also revealed Hancock Victorian Plantations – which operates in the Green Triangle – also paid no tax despite earning $385m.

The ATO has published the corporate tax transparency report for 2015/16, which includes the tax information of more than 2000 large companies operating in Australia.

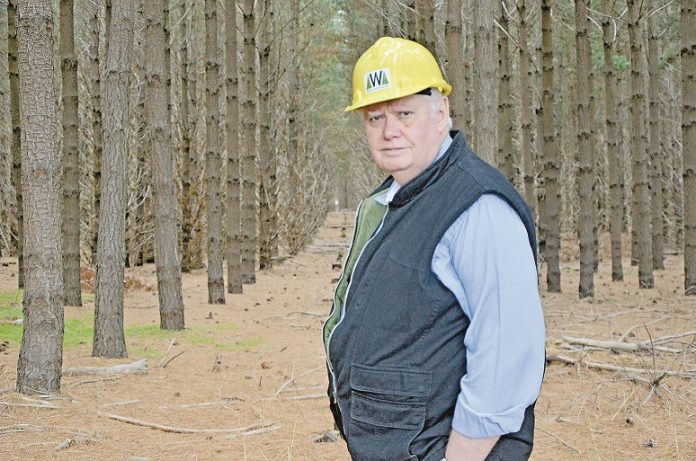

Mount Gambier forestry industry consultant Dr Jerry Leech said he was surprised by the results of the tax report.

“I am surprised OFO have not paid tax, they earned a lot of money,” Dr Leech said.

In response, OFO stood by the fact it did not pay tax.

“The inclusion of OneFortyOne in the ATO tax data reflects that our allowable reductions exceed our assessable income,” a spokesperson said.

Limestone Coast Protection Alliance joint chair Angus Ralton said he was flabbergasted Beach Energy paid no tax.

“Beach has already got $6m from the State Government – this is further evidence how they take money and give nothing back,” Mr Ralton said.

“What they give back to the community is minuscule in comparison to what they have been given.”

But a Beach Energy spokesperson said the company paid its share in tax.

“Beach Energy is proud to pay its fair share of tax to help fund schools, hospitals and police officers,” the spokesperson said.

“In the past two year Beach Energy has paid more than $75m in taxes and royalties.”

The ATO report includes 1693 Australian public and foreign-owned companies with an income of $100m or more and 350 Australian-owned resident private companies with an income of $200m or more.

Deputy Commissioner Jeremy Hirschhorn said the community should have confidence the largest companies were being required to pay the right amount of tax on their Australian profits and most do so voluntarily.

But he said it was important to remember that corporate income tax is payable on profits and not gross income.

In any given year a significant percentage of even the largest companies make losses, not just for tax purposes, but also for accounting purposes.

He said the information published reflected the state of the economy in 2015/16, which saw a significant drop in profitability of energy and resources companies, a sector where company profits were highly dependent on commodity prices.

“On the back of solid growth in company profits and higher commodity prices, we are seeing a strong increase in company tax collections in 2016/17 which will be reflected in the data next year,” Mr Hirschhorn said.

“In addition, we expect to begin to see the impact of the MAAL in the 2016/17 data as companies restructure to comply with the requirements of the new law.

“In the coming years the data will reflect an estimated $7b each year of increased sales returned in Australia as a result of the operation of the MAAL and will also reflect restructures made by companies to avoid paying the DPT.

“Increasingly, the data will also reflect our approach to resolving past matters in requiring future compliance to be locked in.”